Medical Benefits

Eligibility

All regular full-time employees working 30+ hours a week are eligible to enroll in health insurance. Eligibility for newly hired employees is the 1st of the month following 30 days of full-time employment. Current, eligible employees who have elected to waive coverage are able to enroll during Open Enrollment. Only if they experience a qualifying event (including losing coverage elsewhere, getting married, having a baby) are they able to enroll outside of the open enrollment period.

Domestic Partnership: An employee’s domestic partner and domestic partner’s dependent children can enroll in the Badger health insurance and dental insurance plans. To enroll, an Affidavit of Domestic Partnership needs to be signed by the employee and the partner. Domestic partners’ qualified medical expenses are NOT eligible for reimbursement through the FSA or HSA, unless they are also qualified tax dependents.

Benefit Information

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next enrollment period, November 2025, unless there is a “qualifying event.” See W.S. Badger HR for more information about qualifying events.

All employees should be aware of possible Federal tax penalties for declining Badger’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave Badger?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act. COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

How do I enroll?

During Open Enrollment, your health insurance enrollment must be completed through your ADP password-protected webpage.

Newly hired, regular full-time employees will enroll for health insurance benefits during the new employee orientation period. Eligibility begins the 1st day of the month, following the 30th day of employment.

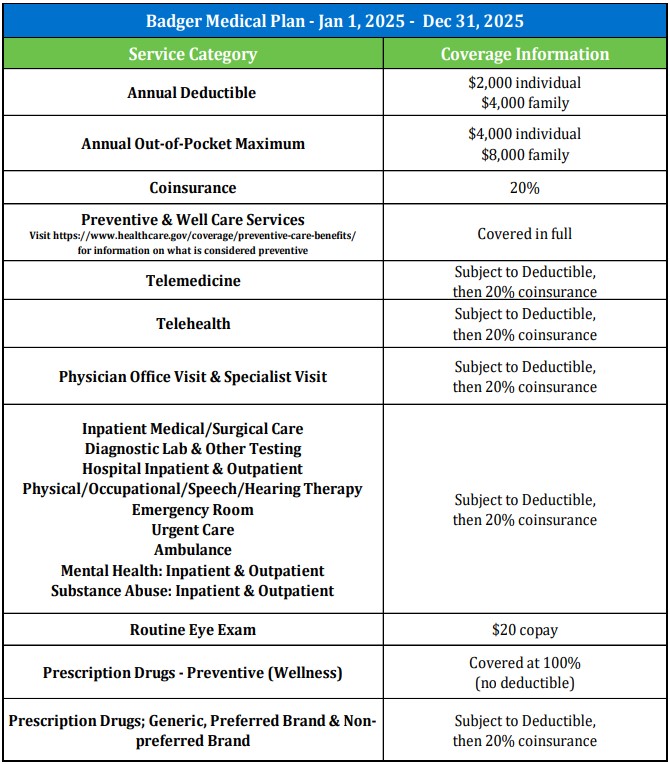

Summary of Benefits & Coverages

W.S. Badger is pleased to offer employees health insurance through HPI for the 2025 plan year.

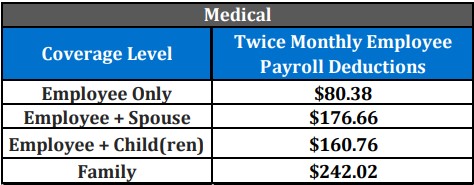

Contributions & Rates

W.S. Badger contributes approximately 80% of the cost of the medical insurance

For coverage 01/01/2025 – 12/31/2025 your twice monthly payroll deductions will be:

Plan Documents

Additional Information

Health Savings Account (HSA)

Health Savings Account (HSA)

W.S. Badger’s health insurance plans are HSA-eligible, which means employees who are eligible to make contributions can establish a personally owned Health Savings Account (HSA).

Individuals can use their HSA funds to pay for qualified medical expenses subject to the deductible of their health insurance plan, or for expenses that are not covered under the health insurance, such as dental or vision expenses, or fees from out-of-network medical providers.

HSA funds can be used to pay for qualified expenses for tax dependents, regardless of whether the dependents are enrolled in the HSA-eligible health insurance plan. Please note, many domestic partners are not tax-dependents which means even if they are enrolled in an employee’s health insurance plan, HSA funds could not be used on their behalf.

HSAs provide a triple tax advantage—contributions, interest and earnings, and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes.

Unused HSA funds can remain in the account until needed. Once the account owner reaches age 65, funds can be distributed for non-medical expenses, but will be subject to ordinary income tax. If withdrawn for non-medical purposes before age 65, the distribution would be subject to income tax and a 20% penalty.

HSA Basics

- In general, money placed into an HSA can be withdrawn at any time. Any HSA withdrawal used for a purpose other than to pay for qualified medical expenses is taxable as income and subject to an additional 20 percent penalty. After an individual reaches age 65, the additional penalty tax does not apply to HSA withdrawals.

- Annual limits apply to HSA contributions. In 2025 the maximum total contribution amount for an individual is $4,300; for an individual + 1 or more dependent, it is $8,550. This includes employee and employer contributions.

- Individuals who are 55 years old and older are allowed to contribute an extra $1,000 per year to their HSA.

- Because HSA amounts are non-forfeitable, amounts contributed to an HSA can increase savings for future health care needs, even into retirement.

- HSAs are controlled and owned by the individual or employee. HSA owners are responsible for annually reporting HSA contributions and distributions to the Internal Revenue Service (IRS) as an attachment to their IRS Form 1040 (U.S. Individual Income Tax Return).

- HSA contributions are non-taxable, and can be made by the HSA owner, an employer, a family member or any other person for months during which the owner is HSA-eligible.

- HSA funds, including interest and earnings, accumulate tax-free from year to year. HSAs are not subject to the “use it or lose it” rule applicable to health flexible spending accounts (FSAs). HSAs are portable, meaning individuals keep their HSAs even if they change jobs, change medical coverage or make other life changes.

- Even if an HSA owner is no longer HSA-eligible (for example, because the owner is no longer covered under an HDHP), he or she can still use accumulated HSA funds to pay for qualified medical expenses on a tax-free basis.

- HSAs are an inheritable asset. If a surviving spouse is the beneficiary, the spouse becomes the owner of the account and can use it as if it were his or her own HSA. For other beneficiaries, the account will no longer be treated as an HSA, and will pass to a beneficiary or become part of the deceased individual’s estate.

Funding your HSA

- Once a year, at open enrollment, employees may choose to contribute all or a portion of their W.S. Badger Wellness Fund into their HSA. Once an election is made during open enrollment, it cannot be changed.

- Employees may elect to make pre-tax contributions to their HSA via payroll deduction. Changes to payroll deductions can be made monthly.

- Employees (or their family members and friends) can make direct contributions to their HSA account using funds from personal savings or checking at any time, up until April 15th of the tax-filing year.

- Total contributions from all sources can not exceed: $4,300/$8,550 in 2025.

- W.S. Badger’s banking partner Mascoma Bank offers no-fee HSAs to our employees.

Help Center Contact Information

Health Savings Account (HSA): Mascoma Bank

Customer Service: 800-832-5700

Website: www.mascomabank.com

Flexible Spending Accounts

Medical Flexible Spending Account (FSA)

W.S. Badger offers both health (FSA) and dependent care (DCA) flexible spending accounts. Employees may contribute pre-tax dollars into these accounts to help offset eligible medical expenses or dependent care expenses. The FSA & DCA are administered by Health Plans, Inc.

The Health Care FSA is available to all regular full-time or part-time employees, whether or not they participate in Badger’s health insurance plan.

Health Care FSA

Funds from a health care FSA can be used for qualified expenses including medical, dental, vision, deductibles, co-payments and coinsurance. For a full list of qualified expenses allowed by the IRS, see Publication 502 (www.irs.gov/publications/p502).

If you fund an HSA account, you will be eligible for a Limited Purpose FSA which you can use for vision and dental services only.

A debit card will be issued to all participants enrolled in both the healthcare FSA and the limited purpose (dental and vision) FSA. In 2025 the maximum allowable contribution amount is $3,300. With an FSA, the entire elected amount is available on the first day of the health plan year. Plan Year 01/01/25 – 12/31/25.

Once the plan year ends, you will have 90 days to submit reimbursement requests for expenses incurred 01/01/25- 12/31/25. After the runout period expires, up to $660 will automatically roll into the new plan year.

Dependent Care FSA (DCA)

A DCA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care. To qualify for a dependent care FSA, the IRS requires that the dependent care is necessary for you or your spouse to work, look for work or attend school full-time.

In 2025 the maximum amount you may contribute to the dependent care FSA is $5,000 (if single or married & filing jointly) or $2,500 (if married & filing separately)

Please note that the DCA is 100% employee funded and is only available to use as monetary contributions are made. Plan year 01/01/25 – 12/31/25.

Visit www.hpiTPA.com for more information including tools to calculate your tax benefits, election amount estimators, reimbursement forms, direct deposit forms.

For additional questions see HR or contact Health Plans, Inc. at 877-734-7004.

How do I enroll in the Medical Full Purpose FSA or Limited Scope FSA?

Whether you are enrolling for the first time, or continuing to participate in the new plan year, you would need to complete an IPG Flex Enrollment Form, to designate the total amount you have decided to set aside, and to acknowledge the bi-weekly payroll deduction amount.

Once you have made an election, unless you experience a qualifying event, you are unable to make changes until the next open enrollment period.

If you have a balance in your current FSA, and are not renewing for the upcoming plan year, there is nothing you need to do. Up to $640 can be rolled over for your use.

Carrier Contact Information

Flexible Spending Accounts: Health Plans, Inc. (HPI)

Customer Service: 877-734-7004

Website: www.hpiTPA.com

Forms and Plan Documents

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Dental Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible after 30 days of employment.

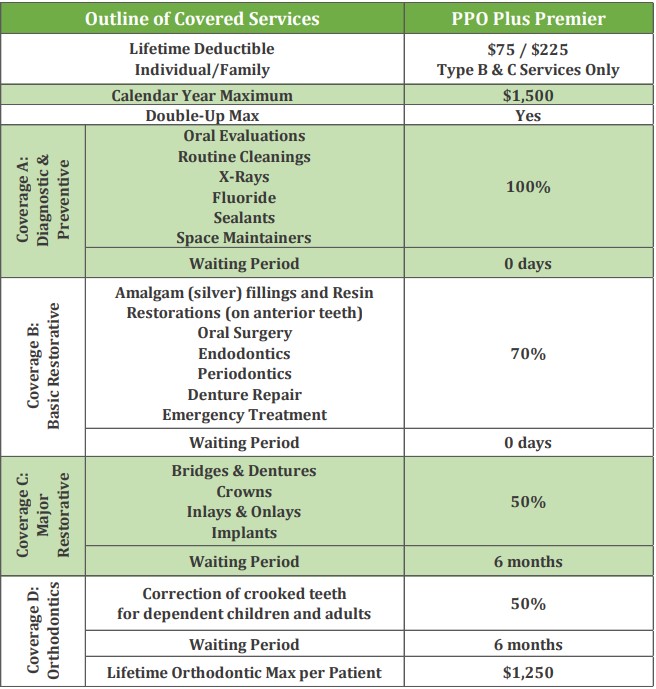

Summary of Benefits and Coverages

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by W.S. Badger

When considering whether purchasing dental insurance makes sense for you and your family, there are three things you should consider:

Network – Where do you and your family receive your dental care? Is your provider included in the network?

Cost to Use – What are the copays, coinsurance, and maximum benefit amounts?

Cost to Own – What will your per paycheck deduction be?

Network

For a complete list of in-network dentists, visit https://portal1.nedelta.com/DentistSearch. In the “Network” field, enter “Delta Dental Premier”.

Cost to Use

After meeting the deductible, you will be responsible for 30% of the cost of in-network basic services, 50% of major services, and 100% of all services once you’ve reached your annual max of $1,500, unless you benefited from the HOW rollover provision, enabling you to accumulate an annual benefit of up to $3,000. You would be responsible for orthodontia costs beyond $1,250 per member, per lifetime.

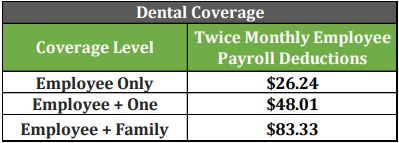

Contributions & Rates

Enrolled employees pay 100% of the premiums through twice monthly payroll deductions.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to either an FSA or HSA be a less expensive way for you to pay for dental care?

How do I enroll?

If you are already enrolled in Badger’s Delta Dental plan and are not adding or removing dependents from your plan, all you’ll need to do is complete your enrollment in ADP. If you are electing coverage for the first time, or making changes to your coverage level, you’ll need to complete a Delta Dental enrollment form, and make the election in ADP.

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Plan Documents

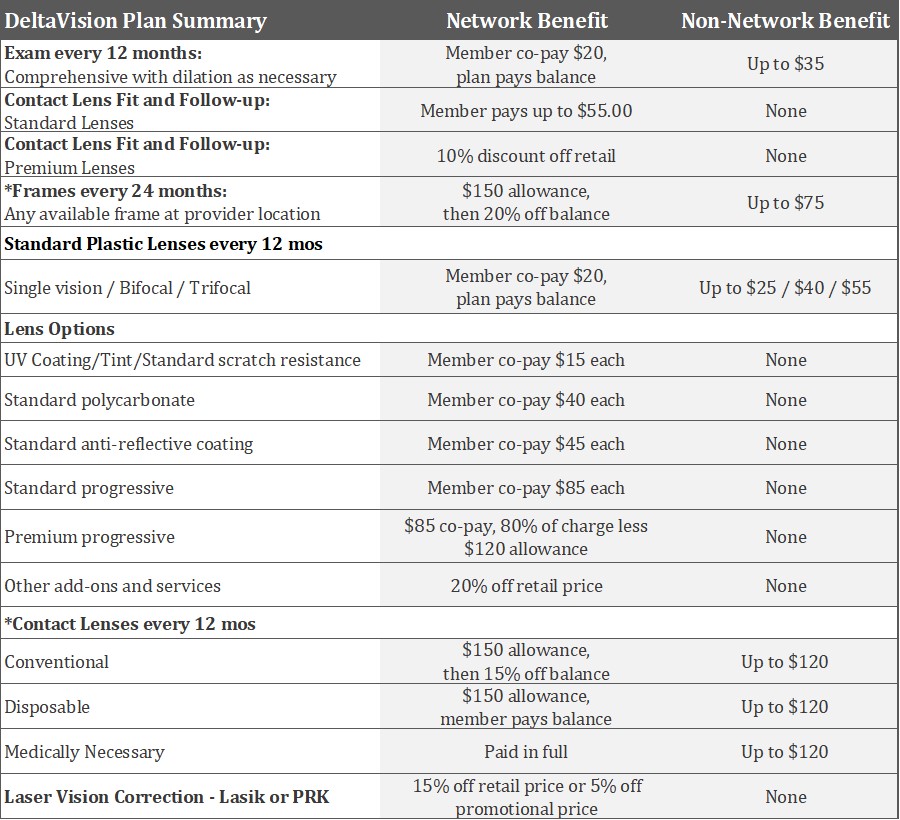

Vision Benefits

W.S. Badger offers a voluntary vision plan through Delta Dental operating on the EyeMed network.

Eligiblity

All employees who work a minimum of 30 hours per week are eligible after 30 days of employment.

Summary of Benefits and Coverages

The chart below provides a high level overview of the vision plan design and features offered to eligible employees by W.S. Badger

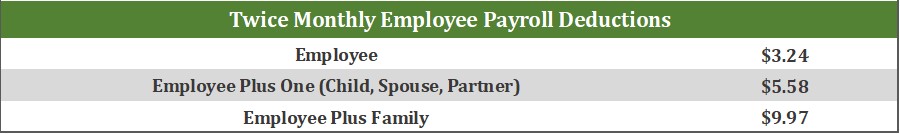

Contributions & Rates

Enrolled employees pay 100% of the premiums through twice monthly payroll deductions.

How do I enroll?

If you are electing coverage for the first time, or making changes to your coverage level, you’ll need to complete a Delta Dental vision enrollment form, and make the election in ADP.

Carrier Contact Information

Plan Documents

Additional Plan Information

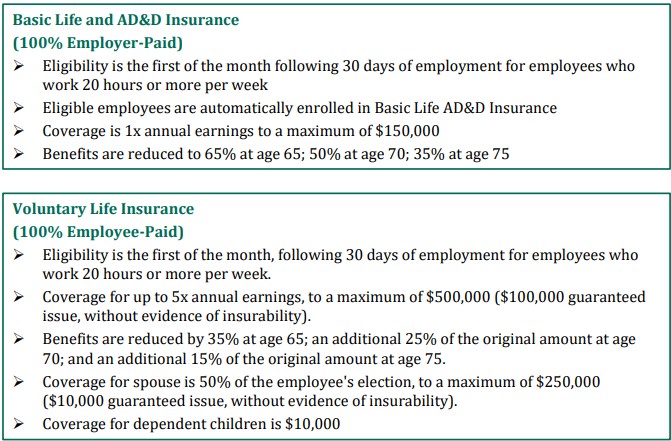

Group Life Insurance

Eligibility

All employees who work a minimum of 20 hours per week are eligible after 30 days of employment.

Summary of Benefits and Coverages

Insurance can play an important role in reducing financial stress when a family is faced with the pre-mature death or disability of a wage-earner.

To help employees during critical times of need, through Symetra, Badger provides employer paid Life Insurance to all regular part-time and full-time employees who work 20+ hours a week. New employees become eligible on the first of the month following 30 days of employment.

Below is a table outlining the benefit coverage:

Carrier Contact Information

Symetra: Life & Accidental Death & Dismemberment Insurance

Customer Service: 800-796-3872

Website: www.symetra.com

Contributions

Group Life is 100% paid for by W.S. Badger.

Voluntary Life is 100% paid for by the employee.

Forms & Plan Documents

Evidence of Insurability Forms

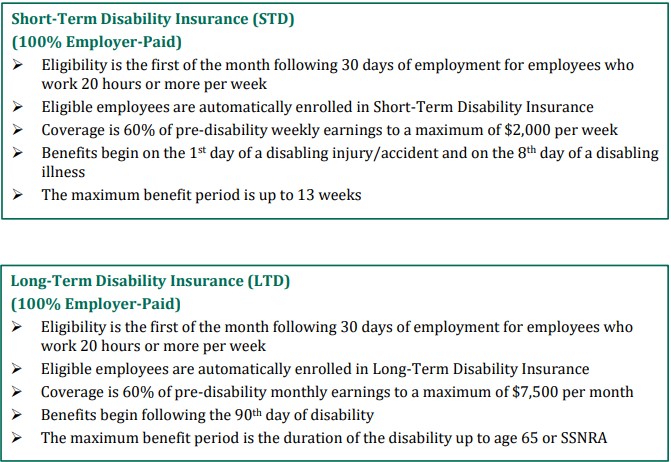

Long-Term & Short-Term Disability

Eligibility

All employees who work a minimum of 20 hours per week are eligible after 30 days of employment.

Summary of Benefits and Coverages

Insurance can play an important role in reducing financial stress when facing a the disability of a wage-earner.

To help employees during critical times of need, through Symetra, Badger provides employer paid Long-Term and Short Term Disability insurance to all regular part-time and full-time employees who work 20+ hours a week. New employees become eligible on the first of the month following 30 days of employment.

Below is a table outlining the benefits coverage:

Carrier Contact Information

Symetra: Long-Term & Short-Term Disability Insurance

Customer Service: 800-796-3872

Website: www.symetra.com

Both LTD and STD Insurance are 100% covered by W.S. Badger.

Forms & Plan Documents

Pet Insurance

Eligiblity

All employees who work a minimum of 30 hours per week are eligible after 30 days of employment.

W.S. Badger offers access to Pin Paws Pet Care insurance through MetLife, at discounted rates.

Pet insurance is a health care policy purchased by a pet owner to help decrease the overall costs of expensive veterinary care. This policy covers the cost of treating unexpected illness and injury, administered by a licensed vet, emergency clinic or specialist.

The cost of Pet Insurance will vary depending on your animal, age and breed.

Why do I need pet insurance?

- Every six seconds, a pet owner is faced with a vet bill of over $1,000. For most, that’s a hard financial burden.

- Having a pet insurance plan helps owners afford vet care when their furry friend is sick or gets into an accident.

- Pet insurance can help owners make the decision between the life of their pet vs financial euthanasia.

- When deciding whether or not you need insurance, consider the cost of treatments without pet insurance.

What makes Pin Paws Pet Care different from other pet insurance companies?

- Coverage for cats and dogs of all ages and breeds

- No initial exam/past vet notes required

- Accident coverage starts at midnight

- Customizable deductible and out-of-pocket max

- Annual max payouts as opposed to per incident

- Choose your reimbursement percentage

- Multiple value-added benefits included

- Routine care options available with customized plans

- Available in all 50 states

Carrier Contact Information

Pin Paws: Pet Insurance

Customer Service: 844-746-7297

Website: www.pinpaws.com/pin-paws-pet-care/

Website Specific for Badger: Pinpaws.com/badgerpets

Badger Wellness Fund

Eligibility

All employees who are Regular Full Time with 30+ hours a week are eligible to participate for the full amount of the benefit. Part-time employees will be prorated. New employees become eligible after 30 days of employment.

Summary of Benefit

W.S. Badger funds and administers our own general health and wellness reimbursement plan. The Badger Wellness Fund reimburses for both qualified and specific non-qualified expenses used to maintain good health.

Total available Wellness Fund dollars for full-time, regular employees for the January 1, 2025 – December 31, 2025, plan year is $1,000. Part-time employees receive a prorated amount.

Once a year, at open enrollment, employees may choose to contribute money from their Wellness Funds into their H.S.A. Employees may elect to contribute any portion of their wellness funds (up to $1,000) but are unable to change their decision throughout the year. This one-time lump sum employer funding is tax benefited.

With money not contributed to a Health Savings Account:

- Reimbursement is a taxable benefit, paid to you in your biweekly payroll check. Your balance is prorated if you become eligible after January 1.

- Funds not spent in the current plan year do not roll over to the next plan year.

- Expenses incurred by dependent family members are eligible for reimbursement.

- You can use your Wellness Fund reimbursement for items such as athletic equipment (i.e., a bicycle or skis), a fitness center membership or dance classes for your child. If you are enrolled in a medical plan other than Badger’s, you could use Wellness Funds to reimburse yourself for out-of-pocket medical expenses like co-pays and deductibles, or for vision or dental care.

How do I enroll?

Enrollment is automatic. If you are eligible on the 1st day of the new plan year, January 1, you’re automatically enrolled. There is no enrollment application.

New, regular employees become eligible on the 1st day of the month following the 30th day of employment.

Additional Information

Reimbursement forms and additional information about Badger’s Wellness Fund are available from HR and on SharePoint: https://wsbadger.sharepoint.com/SitePages/Human-Resources.aspx

Employee Assistance Program

Eligibility

Available to all employees immediately upon joining W.S. Badger.

Program Details

An Employee Assistance Program(EAP) is offered to all W.S. Badger employees and immediate family members through Symetra.

This is a completely confidential counseling program with up to 5 face-to-face, free of charge, confidential sessions that covers issues such as marital & family concerns, depression, substance abuse, grief & loss, child & elder care referrals, legal consultations, and financial assistance.

Sessions are per household and may be divided among the three types of professionals.

An additional 5 sessions are available if you have a covered disability claim.

For more information, go to www.symetra.com.

ID: SYMETRA

Symetra is available 24/7 to assist you.

Or speak with a specialist at 888-327-9573.

EAP Contact Information

Symetra: Employee Assistance Program

Customer Service: 888-327-9573

Website: www.symetra.com

Additional Information

Identity Fraud Insurance

W.S. Badger offers the Identity Fraud Expense Reimbursement policy from Travelers Casualty and Surety Company of America in order to provide you, your spouse, qualified domestic partner, and children under 18 with this valuable coverage.

Becoming a victim of identity fraud is a frightening, frustrating experience that can happen to anyone at any time. Travelers’ identity fraud specialists can help victims during this difficult time. Not only will they pay for expenses associated with clearing up your credit, but they will also provide you with detailed information on how to fix your credit and resolve other identity fraud issues.

Travelers partners with Identity Theft 911 whose experienced fraud team works closely with victims to learn about the incident, document the case, advise on case resolution, and support victims by providing written correspondence that will help expedite resolution of their situation.

Eligiblity

All employees who work a minimum of 30 hours per week are eligible after 30 days of employment.

Additional Information

For your first visit to the site, travelers.com/Idfraud, enter the following username and password:

Username: Travelers1

Password: Identity2

Please be aware that the username and password are case sensitive. Once you’ve logged in for the first time using the username and password provided above, you will be asked to create your own personal log-in. You will then be able to access exclusive content at any time and at your convenience.

Your policy number is: 106656020

Your coverage limit is: 25,000

Your deductible is: $0

If you are a victim of Identity Fraud, please call Travelers to report your claim: 800-842-8496 or email bfpclaims@travelers.com

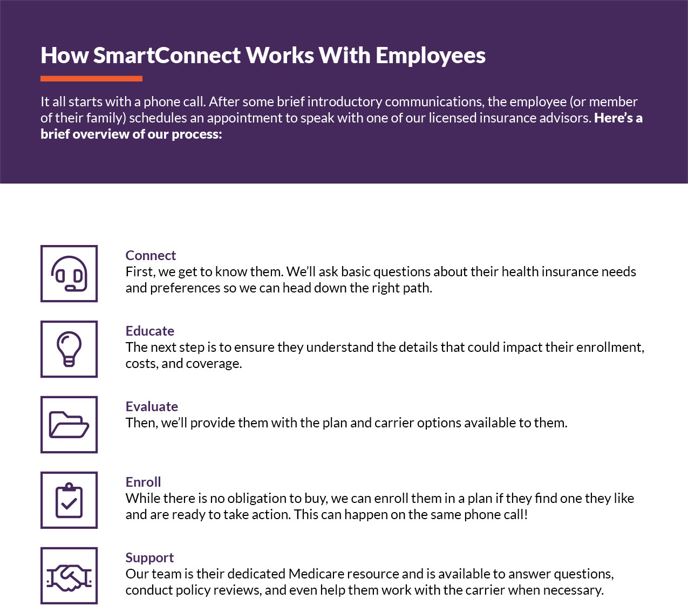

SmartConnect Medicare Resources

Medicare is very complex and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

SmartConnect is a resource that will simplify the Medicare approach by providing you the needed education, plan evaluation and enrollment assistance.

Contact Information

Additional Medicare Resources

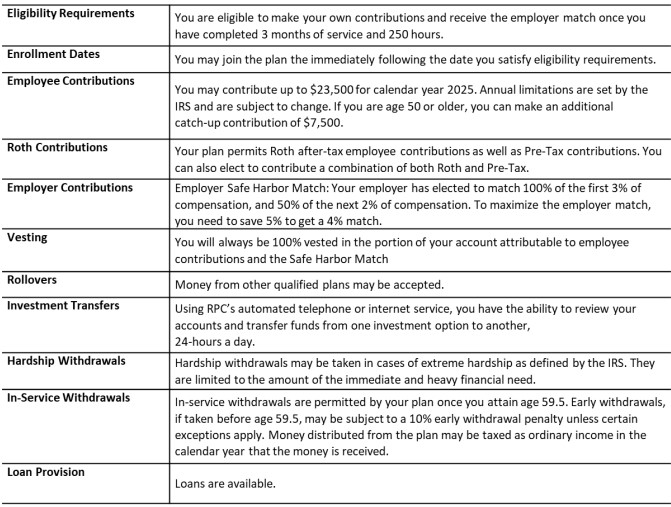

401(k) Retirement Plan Overview

WS Badger offers a 401(k) plan to employees through Retirement Plan Consultants (RPC). RPC offers a wide selection of investment options and excellent online technology to help you better plan for retirement. Basic plan details are listed below. You can find more details outlined in the Summary Plan Description.

If you have questions about the plan, you can send an email to HelpRetire@therichardsgrp.com to receive assistance from TRG Retirement Plan Consultants.

You can also call RPC directly at (877) 800-1114 for transactional assistance or access your account online at https://www.retirementplanconsultants.info/login

Investment Advisor Contact

![]()

Investment Advisor: Allisyn Lambert & Tracey John

Email: HelpRetire@therichardsgrp.com

Phone: 802-254-6016

Free Financial Wellness Resource

Organizing your finances is key to improving your financial well-being. Get started today with Savology, a web-based financial wellness platform that helps you plan and improve your financial future. Start by taking a financial assessment, and receive customized materials made just for you, with resources such as financial literacy courses and planning modules designed to help improve financial outcomes.

Savology is available as a financial wellness and financial literacy resource to all employees, whether or not you choose to participate in the retirement plan.

My Tuition Assistance Benefits

W.S. Badger’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

The Wellness Outlet

W.S. Badger offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/